MARKET UPDATE: May 2021

Market review data for May 2021 provided by West Mercia Energy

Market review data for May 2021 provided by West Mercia Energy

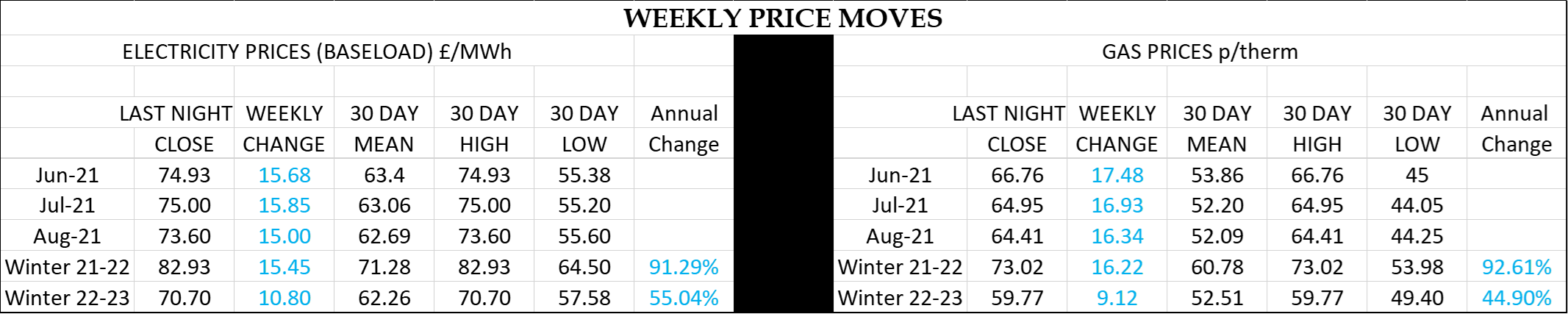

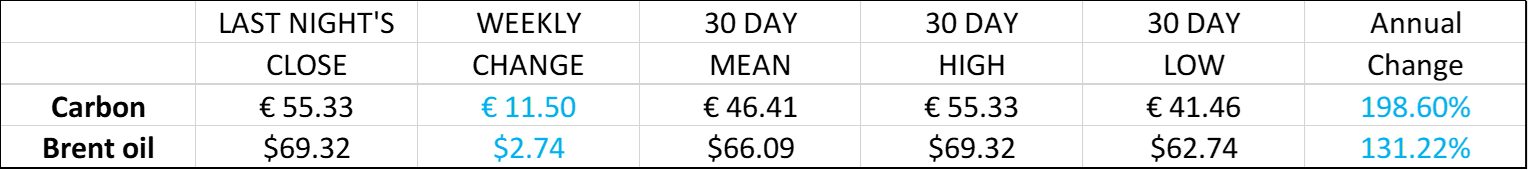

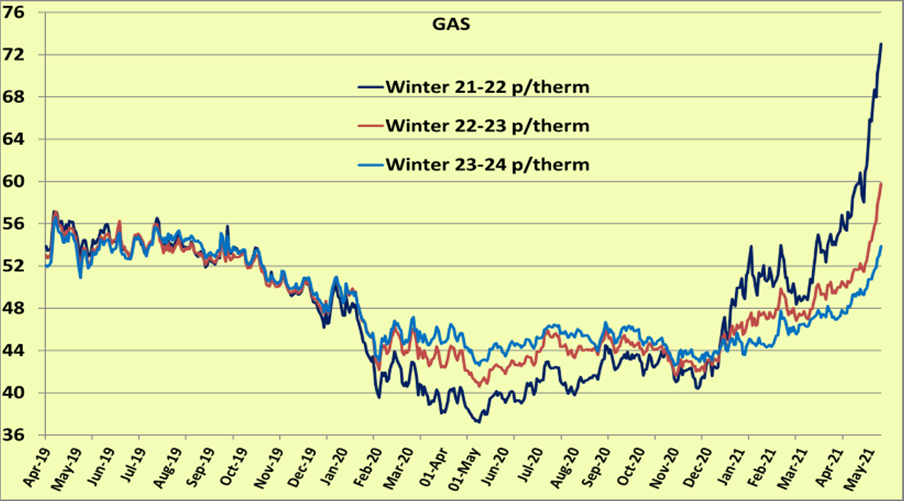

A persistence in the colder weather which we saw during the early part of April has contributed to significant increases in gas and electricity prices in the last month, along with supply concerns, increasing carbon and oil prices and rising Asian gas prices. The graph on the right illustrates the scale of these increases on the Day Ahead gas price which is trading consistently above the levels we saw during the severe cold weather in January. These are unseasonably high prices at a time of year when we would expect Day Ahead prices to be falling due to warmer weather and lower demand. The graph also shows how gas prices for June have increased in line with the Day Ahead gas price and this can also partly explain the increases we have seen from July onwards.

Gas Data

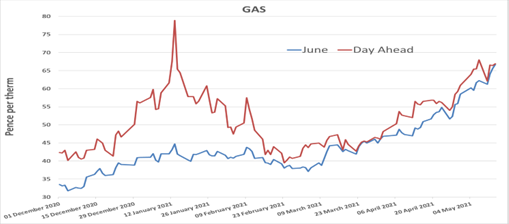

One of the main drivers in the increases that we have seen in gas prices has been concerns regarding low European gas storage levels. As a result of the cold winter in Europe, storage levels at the end of March were below the five year average and were already supporting summer gas prices due to the increased demand to refill stocks. The persistently cold weather in April saw stocks depleted further at a time when we would have expected injections back into storage to have commenced. As a consequence, storage levels are currently close to the five year lows of 2018 when we saw similarly high gas prices throughout the summer. This has increased the likely injection demand for the summer months and increased the risk that storage levels won’t be back to 100% by the start of winter, both factors adding further support to gas prices.

As a result of the relatively low storage levels and the higher gas demand for summer, the role of LNG in meeting this additional demand has become more critical. During the cold winter in Europe and Asia, Europe could withdraw gas from storage to meet demand whereas in Asia there was more dependence on LNG. This can be seen in the graph alongside which shows the exceptionally high gas prices in Asia during January which the UK and Europe largely avoided due to storage withdrawals. As this is no longer an option Europe now needs to compete with Asia for LNG, particularly for US cargoes, and any increase in Asian gas prices will lead to an increase in European gas prices. As can be seen in the graph, Asian gas prices have increased steadily in recent weeks and are now approaching 80p per therm. Allowing for the increased shipping costs for US cargoes into Asia, this helps to explain the high levels of UK Day Ahead prices and for the summer months.

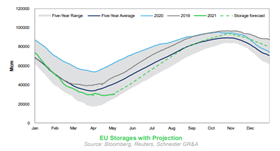

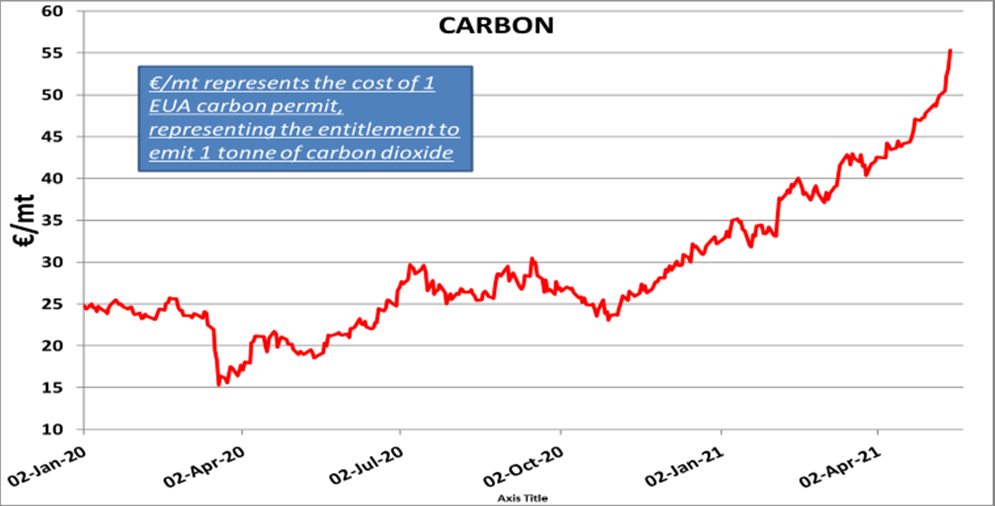

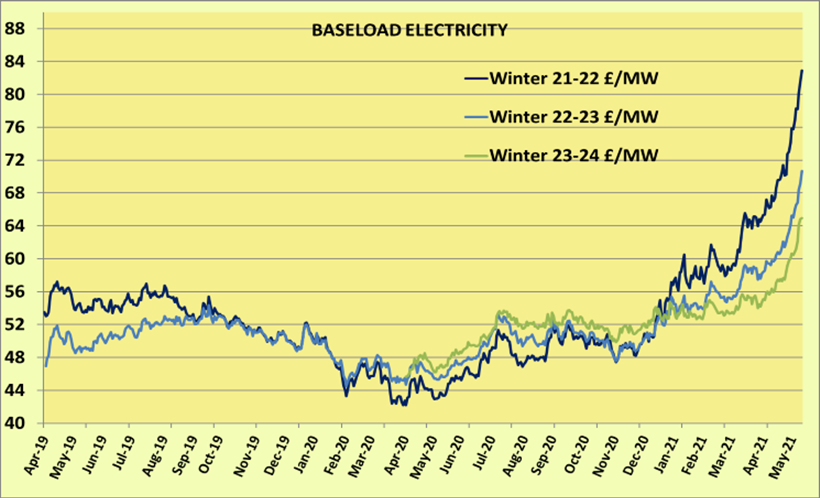

One of the main drivers for the increases in electricity prices has been the increase in gas prices because even with the rapid increase in renewable energy, gas still accounts for approximately 50% of electricity generation. The other main driver in the rising electricity prices has been increases in carbon prices which have broken their record high levels consistently in recent days and have increased by 26% in the last month. As can be seen from the graph, prices have been on an upward trend since November last year, coinciding with the increase we have seen in gas and electricity prices. These increase can be partly attributable to speculation within the market, but also to the EU commitment to reducing emissions. Any hope that the EU would intercede in the market to limit increases were dashed last week when the EU climate spokesman endorsed the higher costs.

Whilst the increases in gas and electricity prices in the last month have been more substantial for the current year, as we can see from the graphs below we have also seen sharp increases in prices for future years, particularly since the beginning of May due to an increase in buying interest for these periods and the need to limit exposure. Given that some of the drivers to the current price increases are potentially short term, such as storage concerns and higher Asian gas prices, these increases for future periods could be viewed as less justifiable.

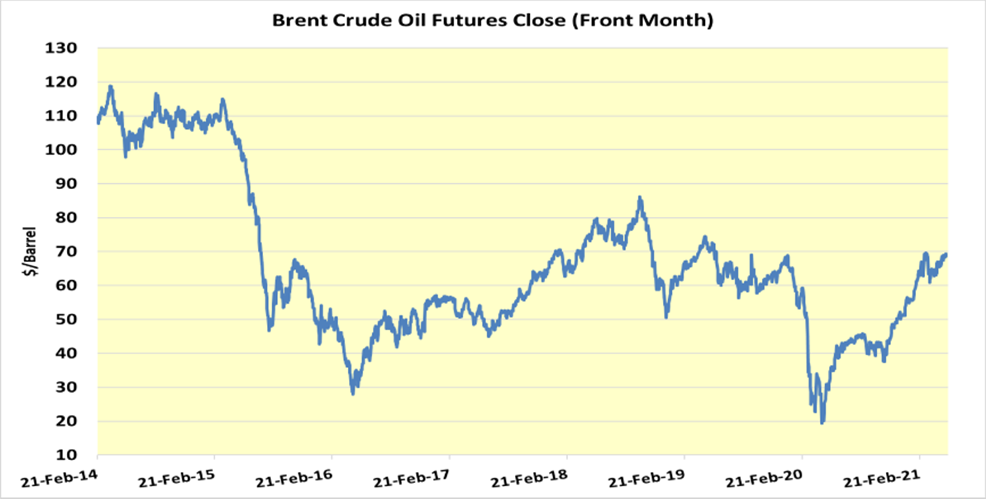

Oil prices are threatening to break thorough the psychological $70 per barrel level once again, and the increasing tensions in the Middle-East may add support in the coming days. OPEC are due to relax their production cuts in the coming months but this is expected to be offset by rising demand although the very high Covid infection rate in India and Brazil could be a limiting factor. Oil prices are important because there are some European and Asian gas prices index linked to oil, and as discussed above, any increases in Asian gas prices are likely to see commensurate increases in UK and European gas prices

The current short term outlook for gas and power suggests continued support for prices. Much will depend on carbon and Asian gas prices. Whilst they remain high they will continue to support gas and electricity. With European gas storage levels low and consequently the demand for gas for injection to remain high throughout the summer, gas prices are also likely to remain high in order to attract additional LNG supply, with the risk of any unforeseen event impacting on supply pushing prices even higher.

In terms of carbon prices a key date is 19th May when the UK carbon scheme is launched with the initial auction of permits. The resulting auction price may have an impact on the EU carbon price. Another short term factor will be the weather - a continuation of colder weather could further limit storage injections adding to the associated risks.